Canadian Dollar Strengthen on Stronger CPI Data

TOPICSTags: Canadian Dollar, CPI, GPD, Inflation, USDCAD

Bank of Canada Less Likely to Deliver Another 50bps Cut

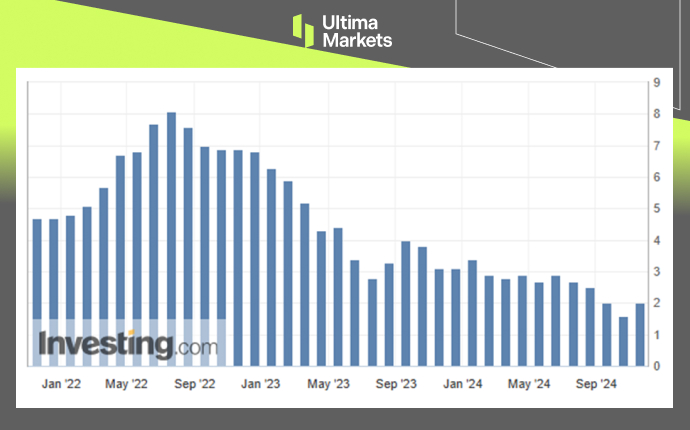

On Tuesday, Canada’s annual inflation rate rose to 2.0% in October from 1.6% in September, exceeding economists’ forecast of 1.9%, as gas prices declined at a slower pace than in the previous month. This led to a strengthening of the Canadian dollar, causing USDCAD to drop 0.42% and close at 1.3956.

(Canada CPI y/y Chart, Source: Investing.com)

(USDCAD Daily Price Chart, Source: Trading View)

The hotter-than-expected inflation report has somewhat reduced the likelihood of a larger rate cut in December, though key developments remain ahead. The Bank of Canada previously lowered rates by 50 basis points in October, marking the first cut of this size in 15 years outside of the pandemic era.

As a result, money markets now see a 23% chance of the BoC cutting interest rates by half a percentage point at its next policy meeting on Dec. 12, down from 38% before the inflation data. Additionally, upcoming third-quarter GDP data on Nov. 29 and the November employment report on Dec. 6 are expected to further shape market expectations for BoC easing.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server