Inflation in Canada Dips to Lowest Level in Three Years, Raising Odds of June Interest Rate Cut

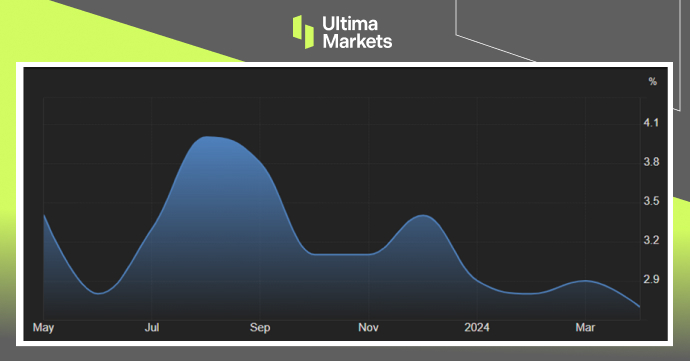

TOPICSThe Canadian Consumer Price Index (CPI), which measures inflation, decreased to an annual rate of 2.7% in April, down from 2.9% in March, according to Statistics Canada’s report released on Tuesday. This figure matched market expectations. The government agency attributed the slowdown in inflation to a deceleration in price increases for food, services, and durable goods.

On a monthly scale, the core CPI, which excludes the more volatile food and energy prices, stayed the same, while the overall CPI rose by 0.5%. Additionally, the Bank of Canada’s core Consumer Price Index saw a yearly increase of 1.6%, dropping from a 2% increase in March and hitting a three-year low.

The Canadian dollar depreciated, crossing the 1.36 mark against the US dollar, distancing itself from the five-week peak reached earlier in the month. The move follows recent inflation figures that have heightened speculation about the Bank of Canada potentially reducing interest rates as early as next month.

(CPI YoY%,Statistics Canada)

(USDCAD Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server