Understanding PBOC’s Decision to Hold Lending Rates Steady

The People’s Bank of China (PBoC) recently announced its decision to maintain lending rates stable, surprising market observers and triggering widespread market downturns. This move, which came amid expectations of further easing, reflects the central bank’s cautious approach towards monetary policy adjustments.

Stability in Lending Rates

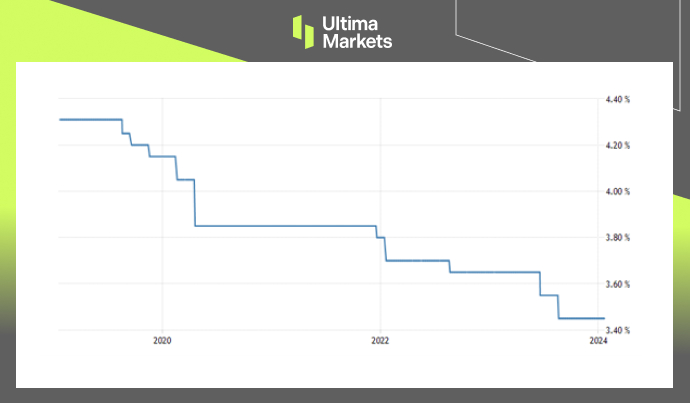

The PBoC’s decision means that the medium-term lending facility, including the one-year loan prime rate (LPR) and the five-year rate, remains unchanged. The one-year LPR, crucial for both corporate and personal loans, stands at a historic low of 3.45%, while the five-year rate, a key determinant for mortgage rates, remains steady at 4.2%.

(China Loan Prime Rate, PBoC)

Impact on Market Sentiment

Following the announcement, both the Shanghai Composite and the Shenzhen Component experienced significant declines, with the Shanghai Composite dropping by 2.68% and the Shenzhen Component plummeting by 3.5%. This decision defied market expectations, leading to broad selloffs and exacerbating concerns about the Chinese economy’s trajectory.

(Shanghai Composite Index 5-year Chart)

(Hang Seng Index 5-year Chart)

Economic Outlook

Despite registering a 5.2% year-over-year growth in the fourth quarter of 2023, slightly below expectations, China’s economy demonstrated resilience amid challenges. The GDP expanded by 5.2% annually, surpassing the government’s target and accelerating from the previous year’s growth rate of 3.0%. Various supportive measures, coupled with a favorable base effect, contributed to this growth.

PBoC’s Strategy

The PBoC’s decision to maintain lending rates stable while increasing liquidity injections underscores its focus on balancing growth objectives with financial stability. By opting for targeted measures to manage liquidity and support economic recovery, the central bank aims to mitigate risks while sustaining

Bottom Line

In a surprising move, the PBoC’s decision to keep lending rates unchanged reflects its cautious stance amidst evolving economic conditions. While disappointing market expectations, this decision underscores the central bank’s commitment to maintaining stability and managing risks in the financial system.

Frequently Asked Questions

1. Why did the PBoC decide to hold lending rates steady?

The PBoC opted to maintain stability in lending rates to balance growth objectives with financial stability amidst evolving economic conditions.

2. What are the implications of the PBoC’s decision on market sentiment?

The PBoC’s decision to hold rates steady surprised markets and triggered widespread selloffs, reflecting concerns about the trajectory of the Chinese economy.

3. How has China’s economy performed despite the PBoC’s decision?

Despite the PBoC’s decision, China’s economy demonstrated resilience, with the GDP expanding by 5.2% annually, outpacing government targets and accelerating from the previous year’s growth rate.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server