Reviving Australian Manufacturing: A Roadmap for Success

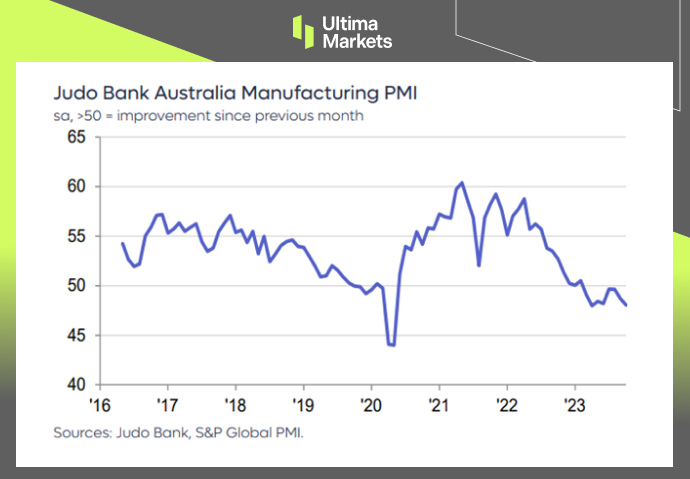

In recent times, Australia’s manufacturing sector has faced a challenging landscape. The Manufacturing PMI hit its lowest level in six months, declining to 48 in October 2023 from 48.7 in the previous month. This marks the eighth consecutive monthly decline in business conditions, a cause for concern.

Understanding the Decline

The Manufacturing PMI decline is primarily attributed to decreased production and diminished new order volumes in response to weakened demand. It’s a ripple effect that has been impacting the industry, causing concern among stakeholders.

Input expenses have witnessed a notable surge, driven by mounting inflationary pressures reaching a peak not seen in seven months. One of the principal contributors to these rising input expenses is escalating fuel costs. Although output charges also rose, the pace of increase was comparatively slower.

The current state of the market is making business sentiment worse than it has been in the past three and a half years. A ray of hope exists in the form of employment levels, which have continued to rise despite these obstacles.

(Judo Bank Australia Manufacturing PMI,S&P Global)

The Role of Composite PMI

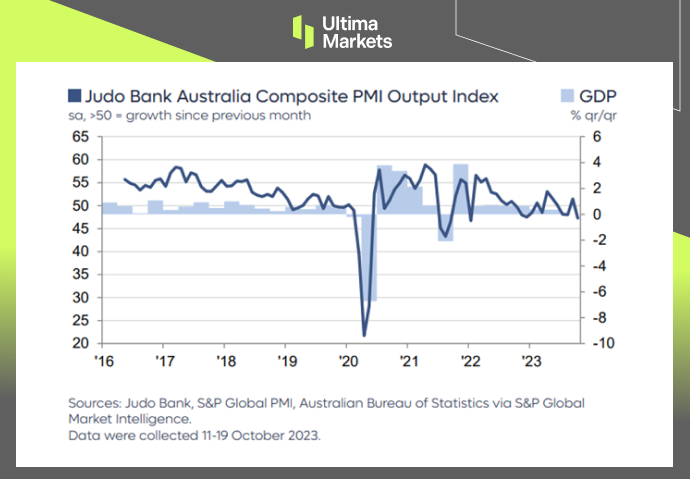

The Composite PMI is equally important in understanding the economic landscape. In October 2023, it dropped to 47.3, plunging from 51.5 in the preceding month. This figure represents the lowest reading observed over a span of 21 months. This significant decline in operational performance across Australia’s private sector is a cause for concern.

The downturn in business activity is a result of several factors, including a reduction in incoming orders, an unfavorable demand climate, mounting inflationary pressures, and elevated interest rates. The volume of new export business experienced a decline for the eighth consecutive month.

Input costs continued their rapid advancement, stimulated by rising inflation that reached a three-month high. Output prices exhibited an increase as well, albeit weakened customer demand exerted pressure on pricing capabilities, resulting in the slowest pace of charge inflation since March 2021.

(The Judo Bank Flash Australia Composite PMI,S&P Global)

A Roadmap for Success

To revive the Australian manufacturing sector and ensure employment stays viable, a well-thought-out roadmap is necessary. Here are some key strategies that can be employed:

1. Innovation and Technology Adoption

The manufacturing sector should invest in research and development to enhance product quality and efficiency. Embracing advanced technologies like automation, robotics, and data analytics can significantly improve productivity.

2. Sustainable Practices

Implementing sustainable practices not only reduces the environmental impact but also attracts consumers who prioritize eco-friendly products. This can create new markets and opportunities for growth.

3. Skills Development

Investing in the workforce is crucial. Upskilling employees to meet the demands of a changing industry is essential. Government incentives and partnerships with educational institutions can facilitate this process.

4. Export Diversification

Reducing reliance on a single market by diversifying export destinations can safeguard against economic downturns in specific regions. Exploring emerging markets and trade agreements can open up new avenues.

5. Government Support

Collaboration with the government for policy changes and financial support is vital. Encouraging initiatives that stimulate growth, such as tax incentives for research and development, can be a game-changer.

Conclusion

To sum up, within the current landscape of Australia’s manufacturing sector, there lie not only challenges but also promising avenues for expansion and renaissance.

Through the wholehearted adoption of innovation, sustainability, skills enhancement, diversification in exports, and the backing of governmental initiatives, the sector can carve a trajectory towards triumph, safeguarding the viability of employment in the process.

Australia’s manufacturing industry has a bright future if it can adapt to the changing times and navigate the challenges effectively.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server